Research suggests that retirees could boost their income by downsizing. While selling your home and moving to a smaller property could be a valuable way to fund your later years, there are some important considerations you might want to weigh up first. Read on to find out more.

Over the last few decades, the value of the average home in the UK has soared. Indeed, according to figures from the Land Registry, the average home was worth almost £85,000 at the start of 2000. Fast forward 24 years, and that figure has increased to more than £280,000.

As a result, your home is likely to be one of the largest assets you own, and you might be thinking about how you could use it to fund retirement.

Downsizing could boost retirement incomes by £1,218 a month

Research from estate agents Savills suggests there are 1.29 million owner-occupiers aged 65 and over living in a four-bedroom house. The study suggests that if these homeowners downsized to a two-bedroom home, they could, on average, unlock £305,090.

Based on using the money accessed to fund 20 years in retirement, downsizing could boost your income by £1,218 a month. While that certainly seems attractive, there are several factors you might need to consider before you start preparing to put your home on the market.

Here are four questions that you may want to answer first.

1. What is the average house price in your area?

Your local property market will affect how much downsizing could unlock, so carrying out some research first may be useful.

Unsurprisingly, the Savills research found there was a significant difference in the amount retirees could unlock depending on where they lived. While Londoners, on average, could boost their monthly income by £2,523 by downsizing, the amount falls to £826 in the north-east.

As well as the value of your current home, you’ll need to consider the value of the property you’ll purchase. In some cases, a smaller property might not be as cheap as you expect. For instance, if you’re considering potential mobility issues and you want to buy a bungalow in a sought-after area, even a smaller property could have a similar value to your current home.

2. Do you have an outstanding mortgage?

If you currently have a mortgage, you may need to factor in paying off the outstanding debt if you’re hoping to unlock money for retirement by downsizing and the effect it could have on your budget when you’re searching for a new home. Depending on your mortgage deal, you might also need to pay an early repayment charge.

Downsizing could be a useful way to clear your mortgage when you approach retirement. It could cut your outgoings and mean you’re more financially secure in your later years. However, it’s not your only option and it is possible to have a mortgage in retirement. If you’d like to discuss the alternatives to downsizing, please contact us.

3. How much will downsizing cost you?

Downsizing could unlock money, but it comes with costs too.

You’ll usually need to pay a solicitor to handle the sale and purchase of property, estate agent fees, and, of course, there will be moving costs too.

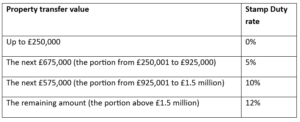

In addition, if the property you purchase is more than £250,000, you’ll typically need to pay Stamp Duty. In 2024/25, in England and Northern Ireland, the Stamp Duty rates are:

Please note: Tax when purchasing property is different if you’re in Scotland or Wales.

So, if you’re buying a new home for £300,000, you’ll normally need to budget £2,500 to cover your Stamp Duty bill.

You should note if you already own an additional residential property, there is usually a 3% surcharge on top of the standard Stamp Duty rates.

4. Do you want to move home?

While downsizing could potentially boost your income in retirement, it’s also important to consider if moving is the right decision for you.

For some, downsizing might not be the right option. Perhaps having extra bedrooms means your grandchildren can visit more often.

Moving to a new area can be difficult too. You may have a lot of happy memories in your current home and you’re reluctant to move as a result. Or your home might be close to family, friends, or local amenities that you’d miss if you moved.

Are you retired or nearing retirement with a mortgage?

As property prices have increased, more households are finding they’re retiring with a mortgage. Downsizing could be one way to pay off the outstanding debt, but if you want to remain in your home, there could be other options too. Please contact us to discuss how you could manage retiring with a mortgage.

Please note: This blog is for general information only and does not constitute advice. The information is aimed at retail clients only.

Your home may be repossessed if you do not keep up repayments on a mortgage or other loans secured on it.